Warehouse Facility Finance

Contact Us

![]()

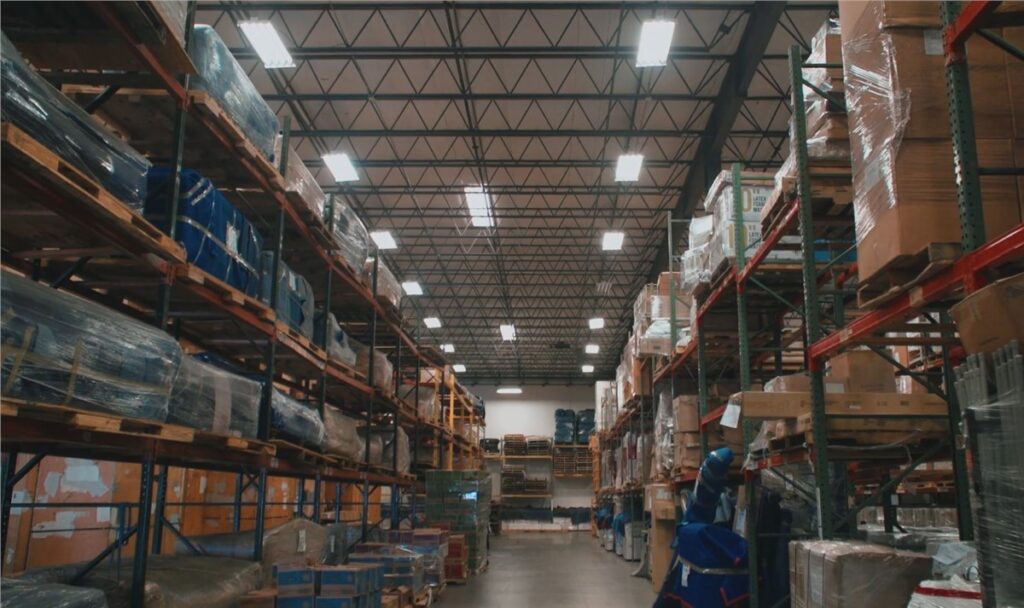

Accessing a loan for your business can be difficult when you don’t have a good credit score or financial records that support your cause. However, when this happens, the best option could be to use your goods and items to access a warehouse facility finance to cover expenses such as acquiring more space.

Loans usually work with the traditional method of studying the creditworthiness of the borrower to determine if they are approved or not. However, everything depends on two things:

- The lender.

- The type of loan you’re requesting.

Following the first idea of traditional credits, you must be familiar with the need of having a financial record and history that shows the lender you’re able to repay the debt. What happens if you don’t have good credit or can’t meet other requirements to show your worthiness? An option that lies more in the collateral for the loan is the best option.

Warehouse loans—not facility finance yet—are based on the inventory or products businesses provide as collateral to finance the repayment of the debt in case a monthly payment is missed or they unable to cover the total amount. We want you to understand this concept of loan so you can have a good idea of the option you have: use goods to finance the credit you can’t with your capital or money.

Now, what does this have to do with warehouse facility finance? That the principle is the same. If you’re a business or company looking for more space to store its products and items, you will need to consider using this option when you run out of capital for it. But this isn’t a type of loan you can access in regular institutions such as banks and insurances or pension funds since most of them are not that interested in what you can offer with the items.

However, private lenders like us at Commercial Real Estate Loan Pros of West Palm Beach can guarantee you get the funds required without having to spend time selling what you have and then, acquiring the space or warehouse facility. With this clear, is it easy to access this financing option? It is even when you don’t meet usual regular requirements.

We make sure to offer the best terms for anyone in need to apply and have a chance to have the loan approved. In this way, you’ll be able to use a part of your inventory or goods to finance the need of more space, which tends to be quite expensive since logistic storage cost is quite high. If you’re paying for space monthly, you will be able to aim for one of your own.

How to qualify for warehouse facility finance

Applying isn’t the difficult part. Thus, you can determine that qualifying for it won’t be as hard as many believe. As we were mentioning before, the loan is based on collateral more than other aspects. As a result, credit score, personal or commercial financial records as well as other documentation or usual requirements, aren’t as important as with other loans.

Therefore, the qualification can be the easiest part even when it depends on the lender and the terms it establishes. In our case, our team at Commercial Real Estate Loan Pros of West Palm Beach has very specific requirements that you must fulfill that are rather a few things you must let us know:

- The collateral you will offer—the type of the products, items, and your inventory.

- Your credit score—despite not being quite essential.

- The value of the collateral you’re offering.

- The cost of the facility.

- The loan term you’re aiming for.

- The interest rate you would like to keep when considering our options—which is negotiable before the final agreement.

Qualifying for this credit with us as your lenders won’t be too difficult. We are very serious about taking the collateral as the most important part since it is what guarantees the repayment in the future in case you’re unable to complete the monthly payments. But this is something most companies fulfill whenever they consider applying for this loan. Therefore, there’s no need to overthink it but rather focus on collecting the information and apply to our financing option.

Terms & conditions for warehouse facility finance

Usually, the conditions aren’t any different from a warehouse loan. But since the amount of the loan tends to be larger than regular ones, the interest rates drop a bit more and you have more time for repayment.

Everything depends on the amount you will request, the time you want to use to pay for it, and the details you look for with the amortization and other rates. When accessing one of our financing options, you can rest assured our terms will be more flexible and reasonable than from most lenders. This means you shouldn’t take examples from other lenders when applying for a loan in our company.

Instead, focus on the average conditions we offer:

- Interest rates from 5% to 15%—can vary and go lower or higher.

- Loan time from 1 to 15 years and goes up depending on the amount.

- Fixed interest rates for most of the duration of the loan.

- Part of the collateral will be sold whenever you don’t meet a payment in order to cover the expenses.

- If you pay monthly, we won’t be touching your goods and collateral and can even return part of it that equals the amount of the debt returned.

- The collateral stays in one of our warehouses or it is negotiable.

With this, we’re confident you will be able to focus on what’s the best approach and if you can afford to apply for one of our financing options. However, we’re confident our terms will be more than appealing since the requirements we mentioned before are also normal for anyone trying to access funds.

Our team at Commercial Real Estate Loan Pros of West Palm Beach will be more than happy to take your application and evaluate it, so you just need to make a decision and let us know if you are interested. And remember, these conditions and terms can vary and will be based on your situation and needs at the moment of making the final agreement.

There are so many areas or regions where we offer these services with most of them being cities.

However, if you need any of these services, you need to contact us. The list below comprises the areas where we offer these services.

We service all counties and cities throughout South Florida. However, if you need any of these services in other cities throughout the state of Florida, please contact us. See what services we offer below: